Are you a homeowner with substantial equity? Do you need cash? What is a cash out refinance? We know that you have questions, and fortunately, Mr. Cooper has answers.

The short answer is this: You might be able to refinance your home and get cash out in the process. This could be a good option if you need cash to pay for college tuition or invest in home improvement projects, or to pay down non-mortgage debt, like credit card bills with higher interest rates.

Interest rates can be a great motivator when deciding whether to refinance your mortgage. You are not likely going to see a sizable return on investment if you’re hiding your money away in a low-interest savings account; however, low interest rates could make a cash-out refinance an attractive option for many homeowners.

Who Can Qualify For A Cash Out Refinance?

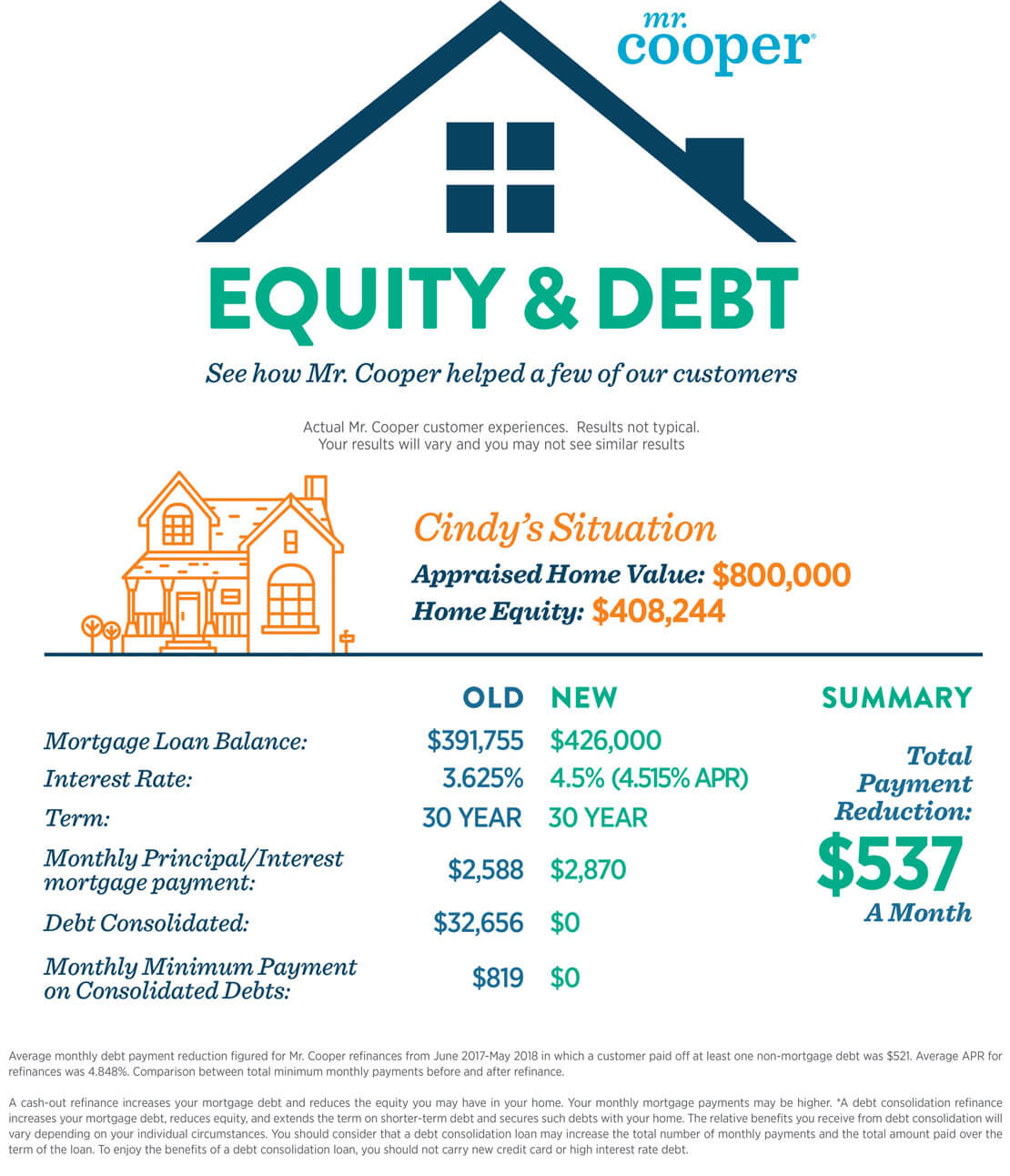

A home refinance with cash-out is not as complicated as it may seem at first glance. Whether or not a borrower can qualify for a cash-out refinance ultimately depends on credit, income, equity, and other factors. Let’s look at a real-world example from a Mr. Cooper customer to explore the cash out refinancing process.

As the above example shows, a cash out refinance can be a great way to consolidate debt for qualified homeowners. Mr. Cooper has helped thousands of mortgage customers, whether they’re buying their first home or refinancing to better their individual financial situation. To learn how we can help you with your financial or home loan needs, contact Mr. Cooper today.

What Can I Do With the Cash Back?

Refinancing can be beneficial for many homeowners, but be sure to research the basics of cash-out refinancing before you apply. Maybe you’ve accrued some significant non-mortgage debt from credit card expenses or old medical bills, or you just learned that you’re expecting a new baby. With a cash-out refinance, you could set up a quick nest egg for some expected or unexpected expenses.

As you contemplate a cash-out refinance, it is important to do your homework and consider the refinance options available to you before you begin the application process. You should carefully examine the pros and cons of refinancing your home before deciding to act. For example, with a cash-out refinance, you take the chance of owing more on your house than it is worth if there is a downturn in the real estate market. You should also keep in mind that you might extend the length of time you will have to make mortgage payments. Having a stable job and the discipline to continue making your payments on time is also very important.

The potential benefits of a cash out refinance could possibly outweigh the risks, depending on your specific situation. If you have substantial home equity and a good credit score and you pay your bills on time, then a cash-out refinance might be just the tool you need to better handle non-mortgage debt and other expenses.

For more information on cash-out refinancing, contact Mr. Cooper today.