In recent years, cash-out refinances have become more popular with homeowners looking to tap into the rising value of their homes in the form of cash. Homeowners can use the cash generated from a cash-out refinance in a variety of ways, and there are several reasons a homeowner might consider it as an option. One of the most logical reasons to consider a cash-out refinance is to consolidate high-interest, non-mortgage debt — but the list doesn’t end there! Here are a few reasons to help you decide whether a cash-out refinance could be right for you.

You Have High-Interest Debt

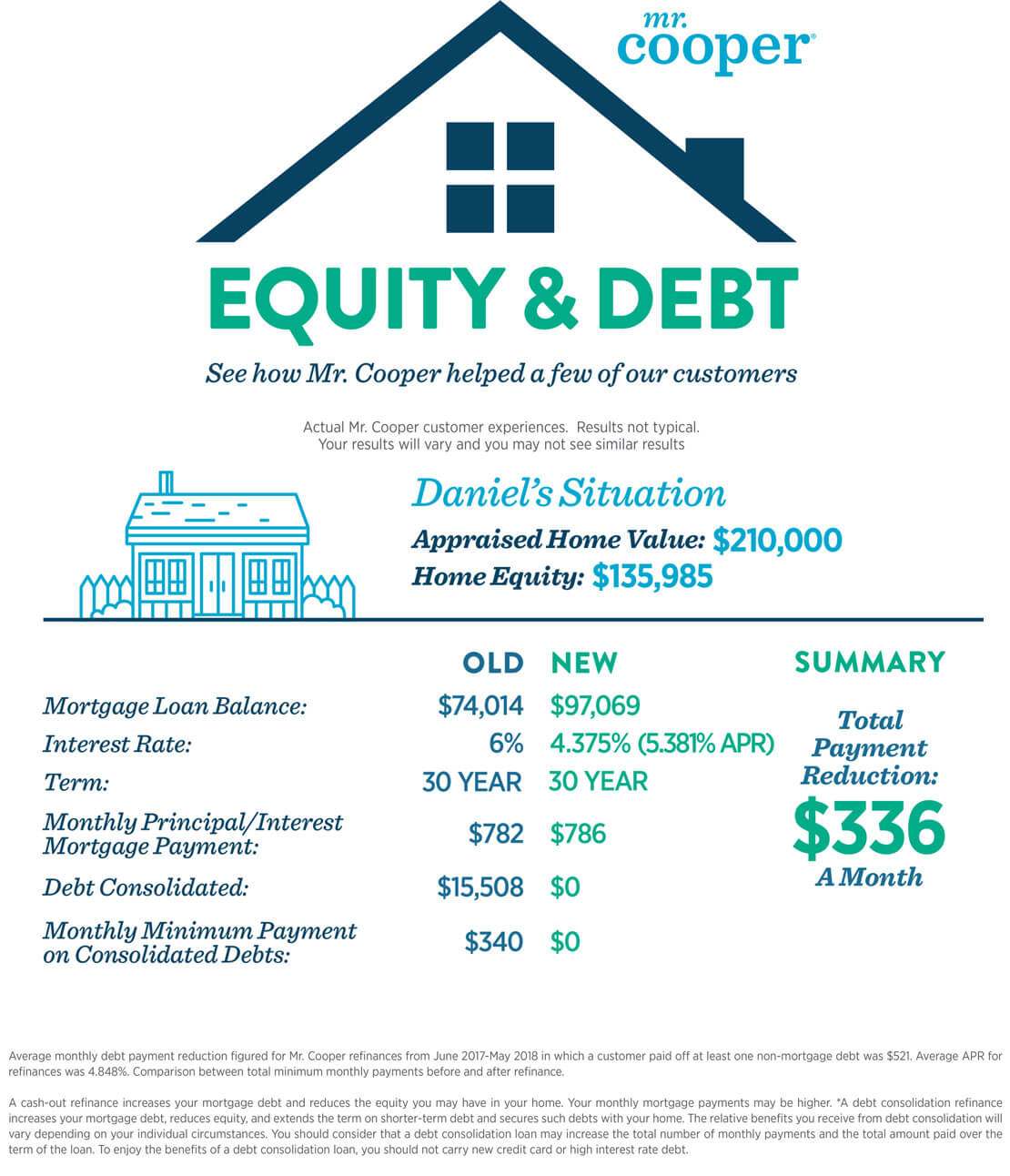

Consumer debt has reached an all-time high, and one of the best ways to consolidate high-interest, non-mortgage debt like credit cards is through a cash-out refinance. If you use the cash from your cash-out refinance to consolidate high-interest rate debt, you can potentially lower your overall monthly debt payments.

Here’s An Example:

You Need Cash For Something

Home values have risen considerably over the last several years in many places. Chances are, if you have owned your home for more than a few years then you may have built up significant equity. A cash-out refinance will allow you to access this equity in the form of cash.

A lump sum of cash from a cash-out refinance can fund almost anything, from typical home improvements — new decks, kitchen upgrades, and even full additions — to consumer items like new vehicles. Do your research to determine the best use of the cash, and keep in mind that a typical mortgage will have a 15 or 30-year term whereas many consumer items will have a shorter life.

Depending on your financial situation, there could be other good reasons to get a lump sum of cash from a cash-out refinance. You might find that a cash-out refinance might be easier than getting other kinds of loans; for example, if you’re starting a new business, funds from a cash-out refinance could be an alternative to taking out a business loan.

You Want To Reduce Your Mortgage Interest Rate

Older home mortgages could have higher interest rates than those available today. If you have better credit now than when you took out the original mortgage, you might be able to qualify for a mortgage with a lower interest rate. Higher interest rate loans combined with higher home values often present a prime opportunity for home refinances with cash out.

Reducing interest rates has the potential to reduce monthly payments or shorten the term of your loan. Consult with a tax professional about mortgages and taxes.

You’re Trying To Improve Your Credit Score

A cash-out refinance could have a positive effect on your credit score because it can help you consolidate and pay down debt. Keeping your credit card balances low can also positively impact your credit score. Your credit score is important for several reasons, including potentially lower interest rates on future loans.

You Want To Simplify Your Finances (And Your Life)

It can be overwhelming to worry about many different debt payments each month. And the costs associated with having a number of high-interest loans can add up over time. High interest debt can include student loans, credit card debt, and vehicle loans, among other types. But by consolidating debt with a cash-out refinance, it might be possible to replace some of your monthly high-interest, non-mortgage debt payments with a single monthly payment.

With fewer payments, you could have fewer bills to worry about. Keeping track of due dates and making payments might become easier to manage each month. Plus, having fewer debt accounts can make tracking your finances a much easier process.