If credit card debt has you tossing and turning at night, you’re not alone. A third of Americans with debt say they’ve lost sleep thinking about it, according to a new nationwide survey conducted by Mr. Cooper, the nation’s largest non-bank mortgage servicer and a leading mortgage lender (infographic).

The survey, entitled “Climbing out of Debt: Finding Solutions for High-Interest Problems,” included 1,00 people with upwards of $500 in credit card debt (click here to read more about it on CNBC). Responses revealed that a majority of Americans — 68 percent — are concerned about their debt. And it doesn’t just affect shut eye; 24 percent of respondents with a spouse or partner reported that their debt had a negative impact on their relationship.

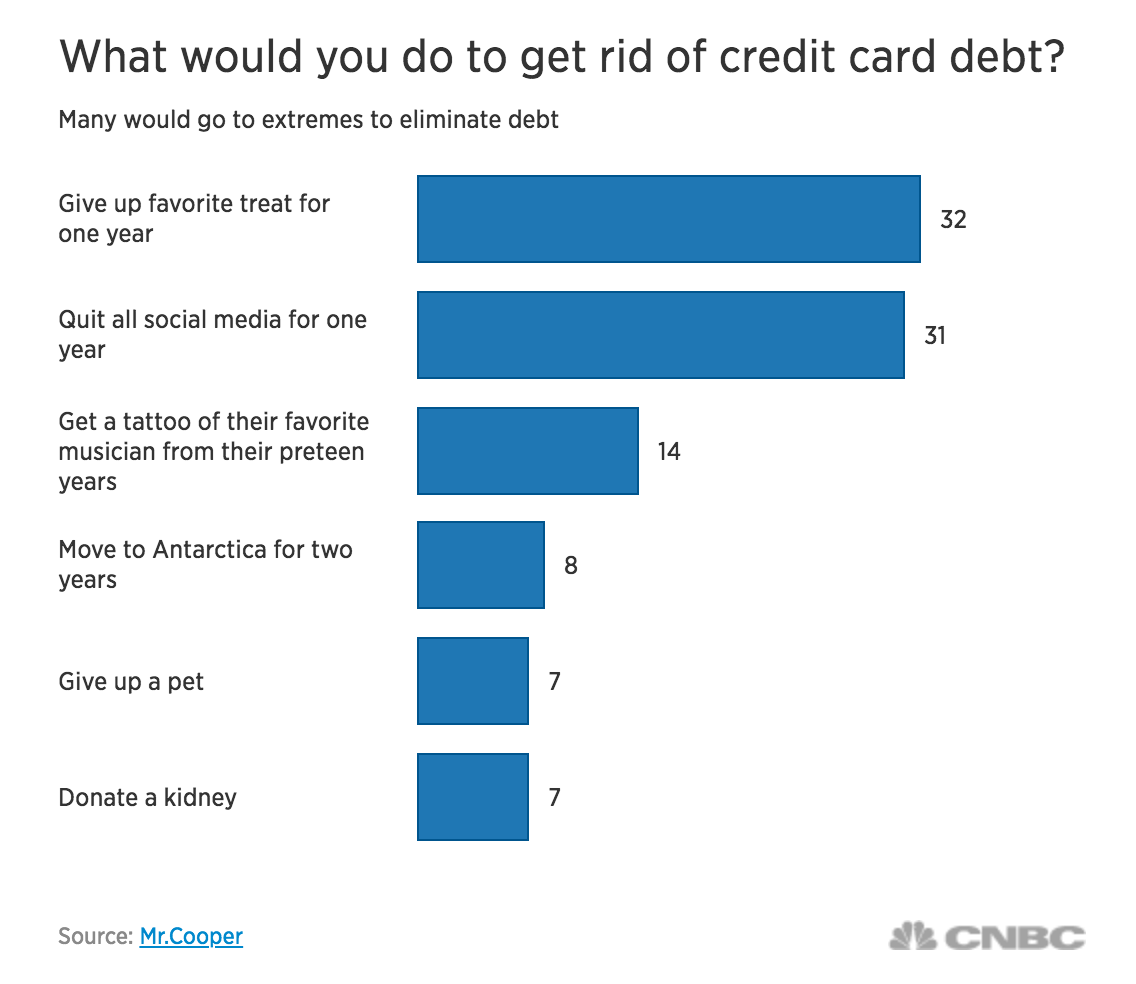

What’s more, Mr. Cooper’s survey found that Americans would be open to unique solutions. More than 30 percent said they would give up their favorite treat for a year in exchange for having their credit card debt forgiven, while 14 percent would get a tattoo of their favorite musician from their preteen years (we won’t ask). Eight percent of respondents said they would move to Antarctica for debt forgiveness.

Jay Bray, president and CEO of Mr. Cooper, points out that homeowners have additional options available to help approach high-interest credit card debt, which overall reached a record high of more than $1 trillion earlier this year.

“At Mr. Cooper, we’re dedicated to educating homeowners about how they can use their greatest asset — their homes — to lower their monthly payments, support their financial goals, and escape the debt cycle that traps so many Americans,” Bray said.

The recently-announced Mr. Cooper with Home Intelligence mobile app — available to Mr. Cooper customers later this summer and widely available shortly after that — will allow homeowners to explore the option of using their home equity to optimize their finances (and more!) from the comfort of wherever their smartphone takes them. In addition to providing insights into how homeowners could use home equity and refinancing options to consolidate their debt and reduce their monthly payments, the app will offer features that assist homeowners in meeting their home loan goals now and in the future.

Click here to learn more about the Mr. Cooper with Home Intelligence app and sign up to be among the first to know when it’s launched.