There’s a lot of information out there about cash-out refinancing and leveraging your home’s equity to pay for things like student loans and credit card debt, but what is home equity? And if you have it, how could you use it to get cash?

Cash-out refinances allow homeowners to tap into the home equity — or the portion of a home’s current value that the owner has paid for so far — and potentially use the resulting cash to cover a variety of expenses. Cash-out refinances allow for consolidating high-interest, non mortgage debt — like credit cards — paying for student loans, financing home improvements, or even starting a business. If you’ve owned your home and made mortgage payments for a while, you might have a substantial amount of home equity to leverage in a cash-out refinance.

Estimating How Much Cash You Could Get

While every situation is unique and dependent on several factors, lenders generally offer lower rates when loan-to-value ratio is at or below 80%. LTV is calculated by dividing the loan amount by the current value of the home, keeping in mind that your home’s value has likely changed since you originally purchased it.

Here’s an example of calculating LTV and using it to determine how much money you could get from a cash-out refinance.

Qualifying For A Cash-Out Refinance

Qualifying for a cash-out refinance is similar to getting a standard home loan. Among other factors, your income, credit score, and the amount of debt will affect the actual amount you qualify to borrow.

Cash-out refinance interest rates could be slightly higher than a standard mortgage. However, interest rates are still near historic lows, and depending on when you bought your home, potentially lower than the interest rate on your current home loan.

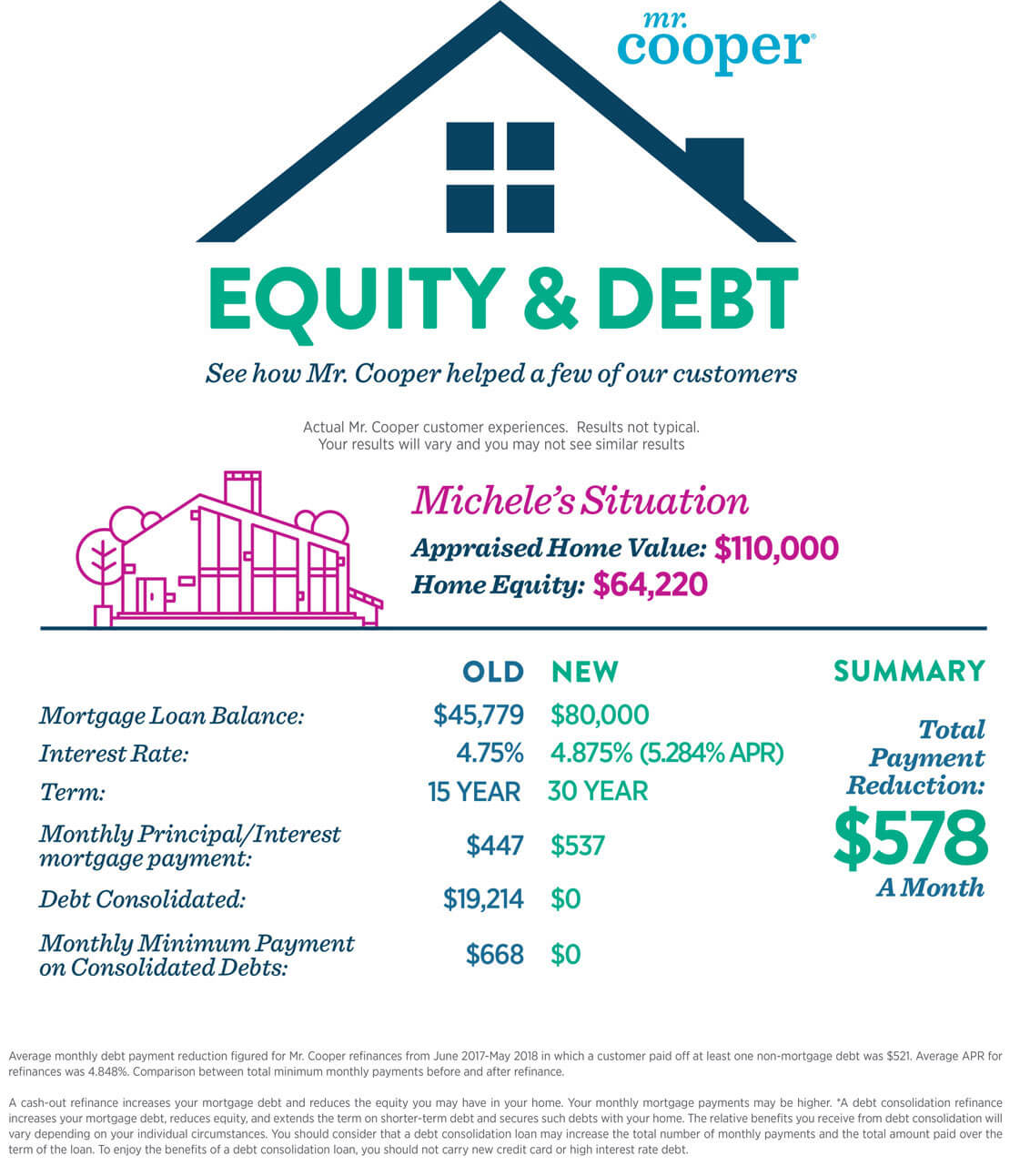

The most important consideration is how the extra cash could ease financial stress. Like Michele in our example, an additional $578* each month could make a difference for many of us. What could you do with some extra cash?